Simple, transparent

pricing for everyone.

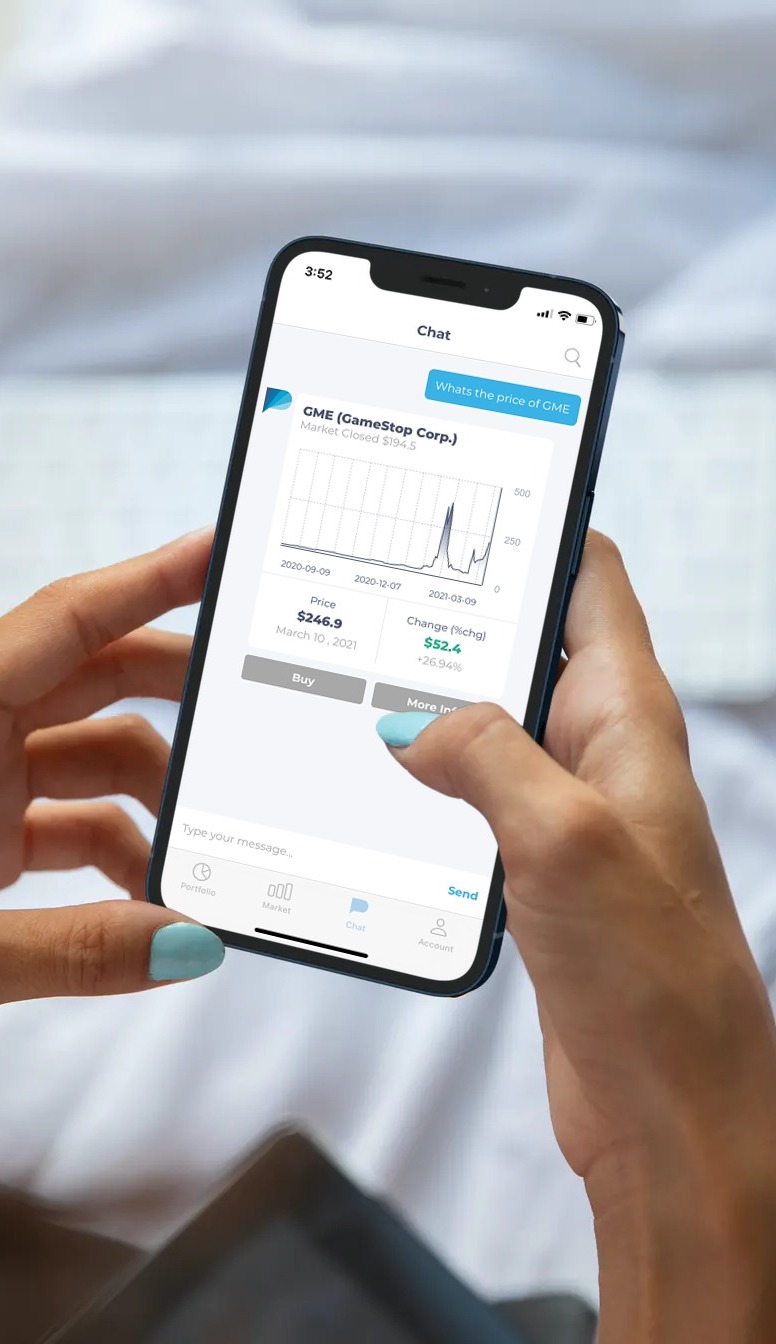

Start investing for free. Upgrade anytime to unlock unlimited stocks, ETFs, and premium features.

No commissions. No hidden fees. No minimum balance required.

Starter Plan

Free forever

Round up purchases into our 5 curated ETFs. Perfect for building the habit.

Includes a 1% deposit fee per auto-invest.

Annual Plan

Save 17% vs monthly

Best value for committed investors

Monthly Plan

Flexible monthly commitment

Transparent Fee

Breakdown

We're committed to transparency. Here's exactly what you'll pay.

Trade Commission

$0Zero commissions on all stock and ETF trades

Per Deposit Fee

1%Basic Account

$0 Subscription

Per Deposit Fee

0%Premium Account

$9 Subscription

Card Processing Fee

2.5% + $0.10Payment gateway fee when using credit/debit card for deposits

International Wire Withdrawal Fee

$60One-time fee charged when withdrawing funds via bank transfer

Re-organization Fee

$10One-time fee for stock splits, delistings, or corporate actions

Why investors

choose premium

Unlimited Access

Trade 6,000+ stocks and ETFs without limitations

No Deposit Fees

Save 1% on every deposit compared to Basic plan

Advanced Trading

Margin investing and day trading capabilities

Community Perks

Exclusive events, merchandise, and member benefits

Alignment matters: With a subscription, we succeed when you succeed. We don't profit from high trading volumes—we profit from your satisfaction and long-term growth.

Choose your path to

wealth building

Start free today. Upgrade whenever you're ready. No commitments, no pressure—invest on your terms.